“Family Office”? Or One Really Insane “Ex-Trader Guy Office”?

In speaking about Archegos with several Family Offices this morning to include one of the largest all that I got in response to my questions and concerns about the possibility of coming scrutiny from the SEC or regulatory bodies due to the debacle were collective yawns and “Ho Hums”.

As one Family Office CIO classically put it ,

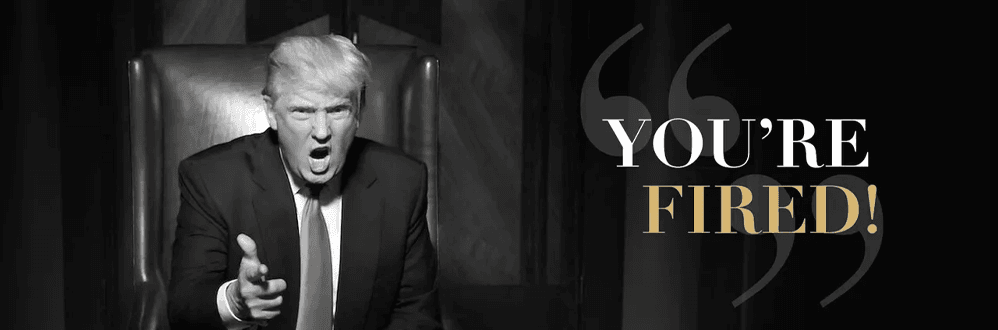

” Family Offices are in the business of staying rich…not getting rich. This idiot was not a Family Office. You take any of these ultra wealth former traders whether it be Ricketts or Cohen or any of them…they aren’t Family Offices they are Hedge Funds..this latest was one really insane ex-trader guy office. What this really does is bring under scrutiny the Prime Brokerage business. It is the direct result of the competitive nature of the Prime Brokerage business. They have literally no controls worth a damn or risk management too speak of if they allowed 20:1 leverage….”

When speaking with another Family Office they as well had some interesting points…

“Wow big surprise the Japanese Banks were involved…what was Credit Suisse even doing near this. Wherever there is a derivative you will find them near by..Whats the old adage? Borrow from the bank 2:1 and the bank owns you…borrow 20:1 and you own the bank….’

Great conversations…the FO space welcomes the scrutiny that may come. Get rid of the Riff Raff and those that don’t belong.

For they are staying rich while the others are trying to get rich….

UPDATE TO ONGOING STORY:

Estimates put Credit Suisse’s losses up to $4B, with Nomura up to $2B. JPMorgan estimated total bank losses to be in the range of $5B to $10B.