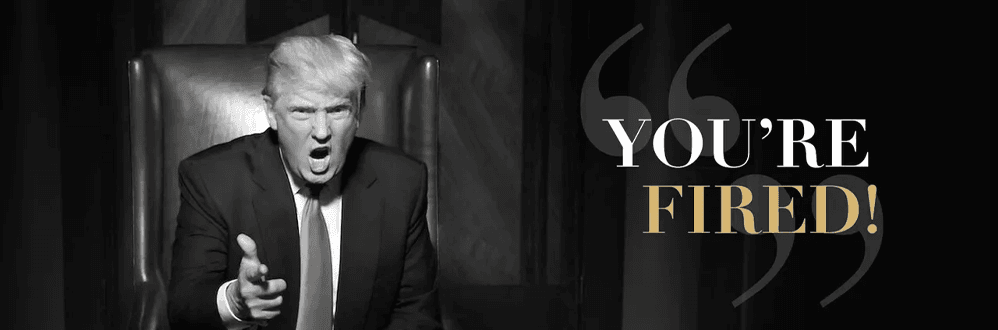

Termination: The Newest Wirehouse Strategy…

Isn’t anyone else seeing whats going on here?

Well first and foremost in this Post Covid world the fastest way to grow your practice as an advisor at a Wirehouse Firm like Merrill or Morgan Stanley is to be a proficient account poacher…taking over clients as everyone leaves like a fire drill in slow motion to go to better situations…or more recently they get terminated.

And Mr. Poacher don’t get too big because you will have a target on your back as soon as your T-12 gets above $1 Million…than its likely that you will get fired.well that is till you get fired. Really lately the BEST job to have within the wirehouse sector is as an advisor attorney.

Hey Merrill Advisor that is STILL there voluntarily and hasn’t gotten fired yet…WTF are you doing? Waiting to grab all that CTP money? That “Succession Plan” which in NO WAY should have the word “success” anywhere near it…the story of CTP or ALPHA or any of them and how great they are is such B.S, You know that business which you spent 20 or 30 or even 40 years building…You are going to hand it over tp Merrill to divvy up to whats left of the office..after Edge gets their chunk….net net you’ll only get about 40% off what you are really worth.

Haven’t you noticed that those advisors that left your wirehouse (at first a trickle….but now..) that you said were just “doing it for the money.,…” are actually happy now and crushing it that boutique or as an independent or having just launched their own firm as an RIA.

So Mr. or Mrs./Ms. Still At MerrillFor No F’in Reason…… –

What exactly is your strategy for growing your business?

Oh I see…you’re doing has been done at Merrill for decades…when those that said just a couple of years ago that they ” Would Never Leave Merrill ” actually do leave the firm (either via resignation or termination) you get handed a bunch of accounts and magically your assets and production grow. Are you proud of that growth strategy as your own firm is becoming more and more unrecognizable. The good news is that account poaching (beyond being an attorney for terminated advisors) is actually looking like the beast way to grow.your business As some of those that said they would “NEVER Leave insert firm name MerrilMorganUBS” are in fact leaving

And….what exactly is your succession plan? Sign the CTP or No matter your tenure time, irregardless of your production or your stature….you may feel “safe” while in your home office – but you aren’t.

As someone that has been working on Wall Street since 1984, got licensed at Merrill in NYC in 1986 and shifted from equity trading to being a financial advisor at UBS in 1998 (yr 1 $850K, yr 2 $1.6M, yr 3 $3.6M) finally after several other career segues I am here talking to you from within our own firm. The point of that background recap was to show you that unlike most of the consultants and recruiters out there I actually know what I’m talking about…I have “been there done that..” Anyways I’m saddened watching the dismantling of what made Merrill great brick by brick, seeing Morgan Stanley use their position of no longer being a Protocol Firm to seek and find not THE BROKER OF THE DAY but THE TERMINATION OF THE DAY

Average advisor age 57 of Barrons

73% of advisors dont have a succession plan in place

Freedom of discussion

Advisors are looking for more freedom – let us do our job …stop bothering and restricting us..

Restrictions on retiring as well as receiving

Merrill CTP : Cannot go anywhere – non-compete 2 years – retiring advisor

Advisors locked up while there are so many changes

Bigger you are the more vulnerable

Zero tolerance – letter of admonishments – internal policy has not been a terminated offense

Firms not sticking by broker – U5 filed takes of to 30 days to be filed

Freedom and flexibility – independent platform…not wait for a problem to occur

Terminated from Merrill cant go to UBS Morga

Managers dont have power

Maximize the value of your business.

Secure harmony among the next generation.

Be ready to seize new opportunities.

Preserve your legacy.

that your ethical values—including environmental, social, and governance (ESG) frameworks—remain core to the running of the business