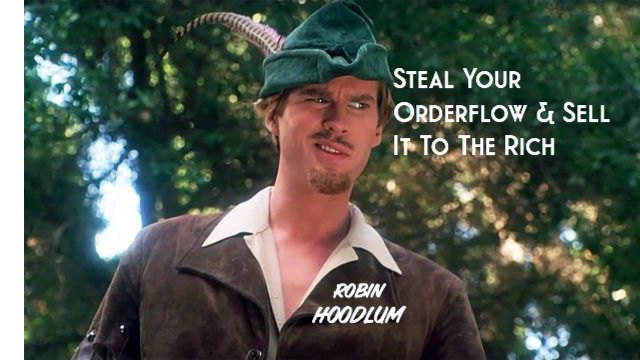

Robinhood Files IPO : Symbol:HOOD(LUMS)

What Follows Is Some Background Info – WHAT WAS NOT WRITTEN BY US Will Be In Italics …

It Is Primarily From Seeking Alpha With Some CNBC Added – Our Commentary Will Follow & Will Be Noted

“Robinhood has sold the world a story of helping the little guy that is the opposite of its actual business model.”

Robinhood Makes It Official

Hot investing app Robinhood Markets (HOOD) filed for an eagerly anticipated IPO at what many on Wall Street expect will be about a $40B valuation. The filing included few other details about the initial public offering, such as how many shares Robinhood will offer or at what price range, but 35% of them are expected to be allocated to retail investors. The company is set to be the buzziest name to tap the U.S. IPO market this summer and follows a record number of listings in the first half that’s on pace to break annual records.

Backdrop: Since 2015, Robinhood has offered a popular, mobile-friendly investing app for Millennials, Gen-Zers and others new to stocks, ETFs and crypto. The company offers such non-traditional features as zero-commission stock purchases and the ability to buy fractional shares, making it possible for small investors to buy into popular but expensive tech stocks. “By untethering investing from the desktop computer, we’ve seen new categories of people, including gig economy workers, first responders, construction workers and many more, discovering Robinhood and becoming investors,” co-founders Baiju Bhatt and Vladimir Tenev wrote in an accompanying S-1 filing.

By the numbers: Robinhood had 18M funded accounts as of March 31, as well as 17.7M monthly active users and $81B in assets under custody (more than 50% of its clients are first-time investors). Revenues grew 245% in 2020 to hit $959M, allowing Robinhood to earn $7M of net income vs. a $107M 2019 net loss. As for Q1 2021, HOOD said revenues grew 309% year over year, although the bottom line showed a $1.4B net loss due in part to a $1.5B fair-value adjustment to convertible notes and warrant liability.

Not without critics: Robinhood has faced heat over receiving what is called “payment for order flow,” where brokerages route customers’ stock orders to specific market makers in exchange for commissions, even though the market maker might not give the customer the best available execution price. Robinhood also angered customers and regulators when its system went down during some big market days in March 2020, preventing clients from trading when stocks were volatile, as well as restricting trading during the meme frenzy back in January. On Wednesday, FINRA announced that Robinhood would pay a record $70M in fines and restitution over the outages, as well as improperly approving some customers for options trading

Robinhood CEO Vlad Tenev’s phone was seized by federal attorneys in one of the stock-trading app company’s many legal battles, it revealed in its IPO filingon Thursday.

In a section outlining legal risks from investigations and subpoenas, the company noted that “a related search warrant was executed by the USAO to obtain Mr. Tenev’s cell phone.” Here, “USAO” refers to the United States Attorney’s Office for the Northern District of California, which was investigating Robinhood’s restrictions on trading during the meme stock flurry around GameStop and other stocks early this year.

The company faces or has faced dozens of proposed class-action lawsuits, as well as examinations or investigations by regulators, state attorneys general, the SEC, FINRA, and the U.S. Department of Justice. The SEC filing notes that the company has “become aware of approximately 50 putative class actions … relating to the Early 2021 Trading Restrictions.”

Robinhood restricted the purchase of “meme stocks” such as GameStop and AMC in January because the company did not have the capital required by regulators to cover the requested trading volume. The company ultimately tapped $500 million through its credit lines and raised $1 billion overnight in order to lift the trading restrictions.

Investors have called the entire episode unfair and unlawful in court records previously reviewed by CNBC.